Paiboon Nalinthrangkurn, Chairman of the Federation of Thai Capital Market Organizations (FETCO), commented on the October 2018 FETCO Investor Confidence Index (ICI):

In September, the Stock Exchange of Thailand (SET) Index during the first part of the month reflected a downward trend over concerns about US import tax policies. The SET Index fell to a low of 1,672 points but rebounded after publication in the Government Gazette of the draft of the act regarding the acquirement of members of parliament and senators and the relaxation of restrictions on political parties, both of which will boost confidence in the upcoming elections being scheduled early next year. The SET Index’ rise to 1,750 points at the end of the month resulted from net buying by local institutional investors.

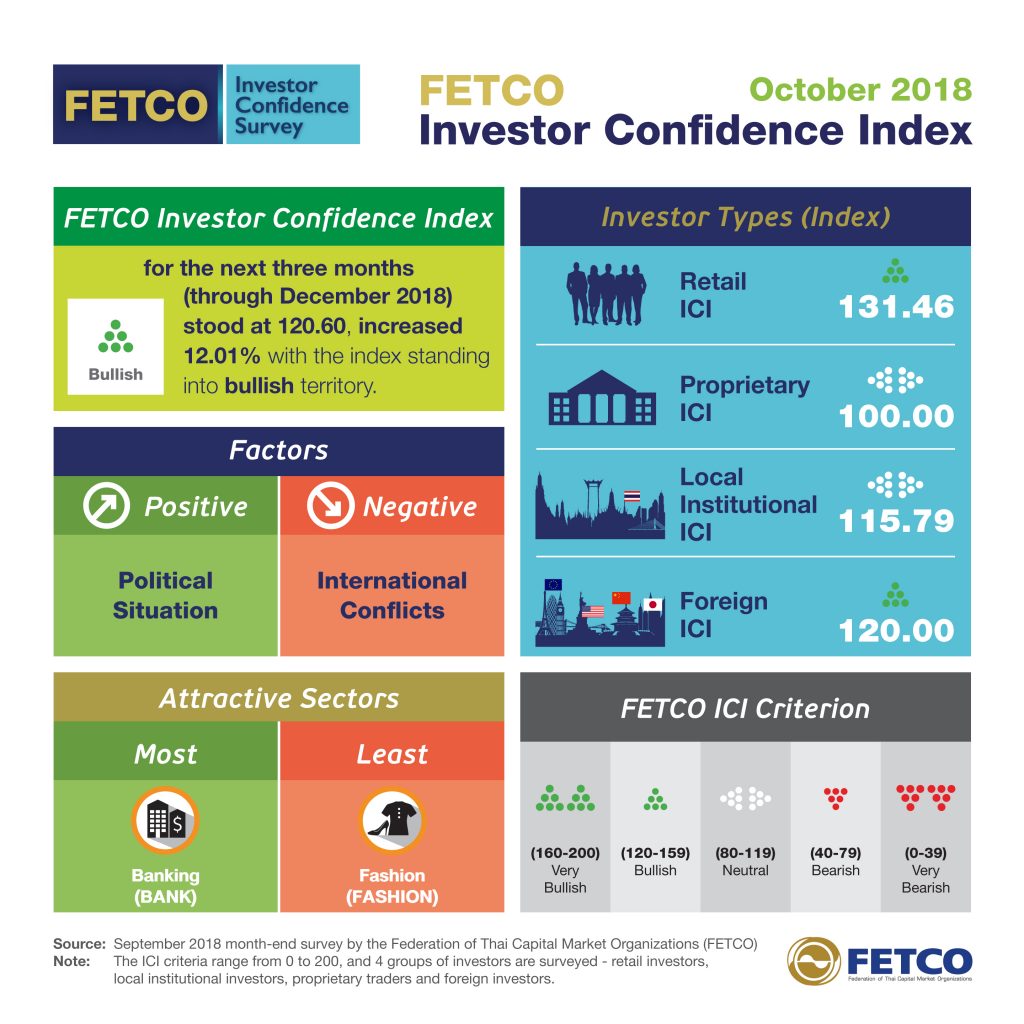

“For investment trends over the next three months, the main factors affecting investors’ confidence include the political situation, Thai economic growth, strong export numbers, and the tourism sector, despite the decline in Chinese tourists. Meanwhile, the price of oil is likely to increase due to the fact that OPEC has not signaled any increase in production capacity as sanctions on Iran will be enforced beginning November 4th. The United States also recently announced an additional USD 2 billion in import duties on goods from China. Significantly, another US policy rate hike of 0.25%—the third for this year—was announced with the likelihood of another increase in December, and such policy rate hikes in many countries and their impact on international capital flows and the value of the US dollar, especially in the emerging markets, are risk factors being closely monitored by investors. Another important factor to consider is the European Bank’s monetary policy of reducing monthly QE from the current 30 billion Euros to 15 billion Euros from October through December, and it is expected that QE measures will terminated at year’s end. Other factors to keep an eye on are the possibility of a Thai policy rate hike at the end of the year and the effects of the trade war on the Chinese and European economies.

TH

TH