Paiboon Nalinthrangkurn, Chairman of the Federation of Thai Capital Market Organizations (FETCO), commented on the August 2018 FETCO Investor Confidence Index (ICI):

Results of the FETCO Investor Confidence Index for August 2018 are summarized below:

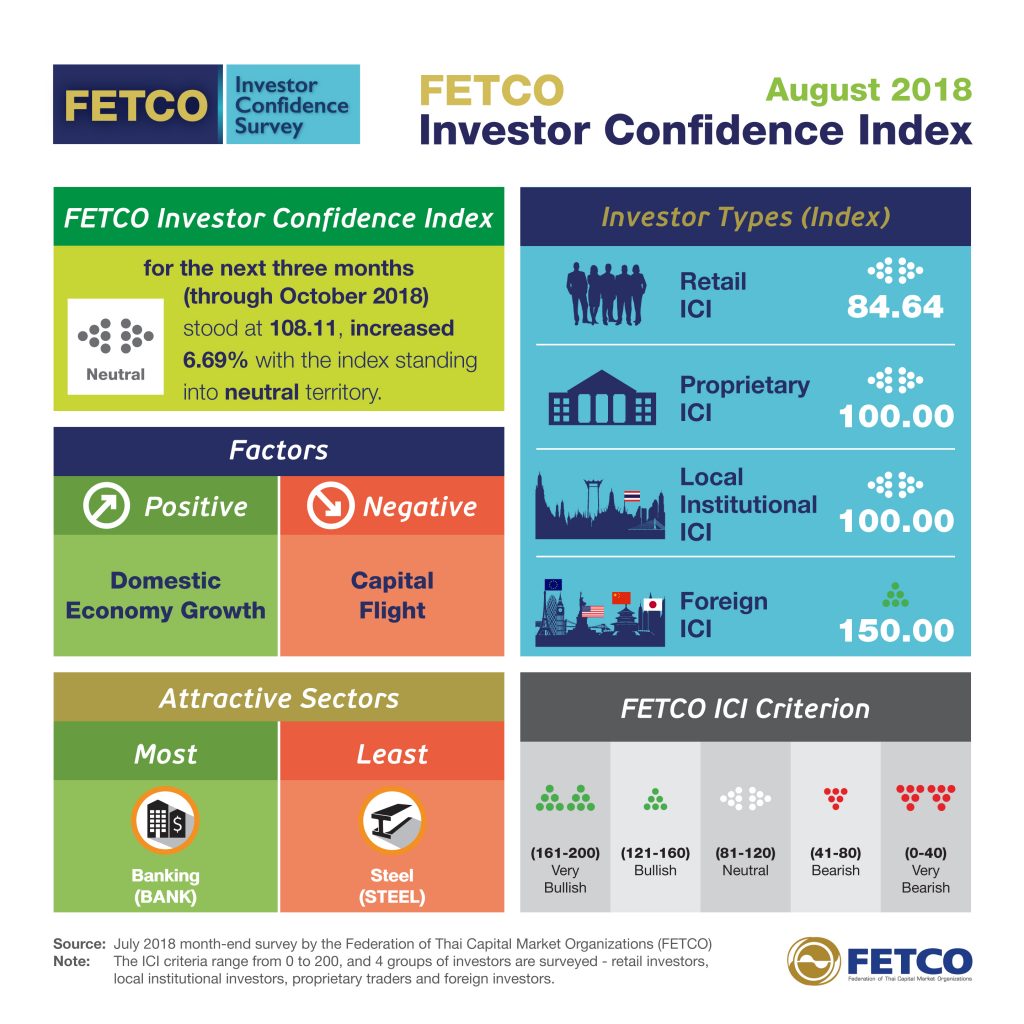

- FETCO Investor Confidence Index (ICI) for the next three months (through October 2018) rose 6.69% to 108.11 and remained in the neutral range of 80–120.

- Foreign investor ICI rose slightly from the previous month and remained within the bullish zone.

- ICIs for proprietary traders and local institutional investors increased slightly while retail investor confidence fell slightly, but all remained within the neutral zone.

- Banking (BANK) was considered the sector with the most interesting investment opportunities.

- Steel (STEEL) was the least attractive sector for investors.

- The factor having the greatest positive impact on the Thai stock market was the domestic economy.

- The biggest drag on the stock market was concern about international capital flows.

“During July, the SET index trended higher in the first half of the month, and midmonth the index continued to increase, rising from a low of 1601.42 at the beginning of the month to a peak of 1701 points at the end of the month. This upswing was driven by the decrease in foreign net sales during July, confidence that Thai economic growth would continue, and projected GDP growth of 4–5% in line with government stimulus measures. For investment trends over the next three months, investor confidence is buoyed by Thai economic growth, expected declines in foreign investors’ net sales, and listed companies’ earnings. Nevertheless, investors are still concerned about international capital flows resulting from trade barriers and trade wars, which pose significant risks to the global economy. Meanwhile, inflation rates and interest rate policies are risk factors that investors are monitoring the most closely. With regard to regional economies, the main issue to consider is the global economic outlook. Although the IMF has estimated that the global economy will continue to grow at 3.9%, there are concerns that trade wars could affect global economic growth in 2020. Other factors include the UK BREXIT negotiations, which appear headed toward compromise; the European Central Bank’s signaling that the current interest rate will be maintained throughout this year; and Japan’s monetary policy may be subject to change. At the same time, the likely impact of trade wars on the Chinese economy must be considered, including China’s easing of monetary and fiscal policies and the depreciation of the yuan, all of which can have an impact on regional economies.”

TH

TH