Voravan Tarapoom, Chairman of the Federation of Thai Capital Market Organizations (FETCO), commented on the monthly FETCO Investor Confidence Index (ICI) for April 2018:

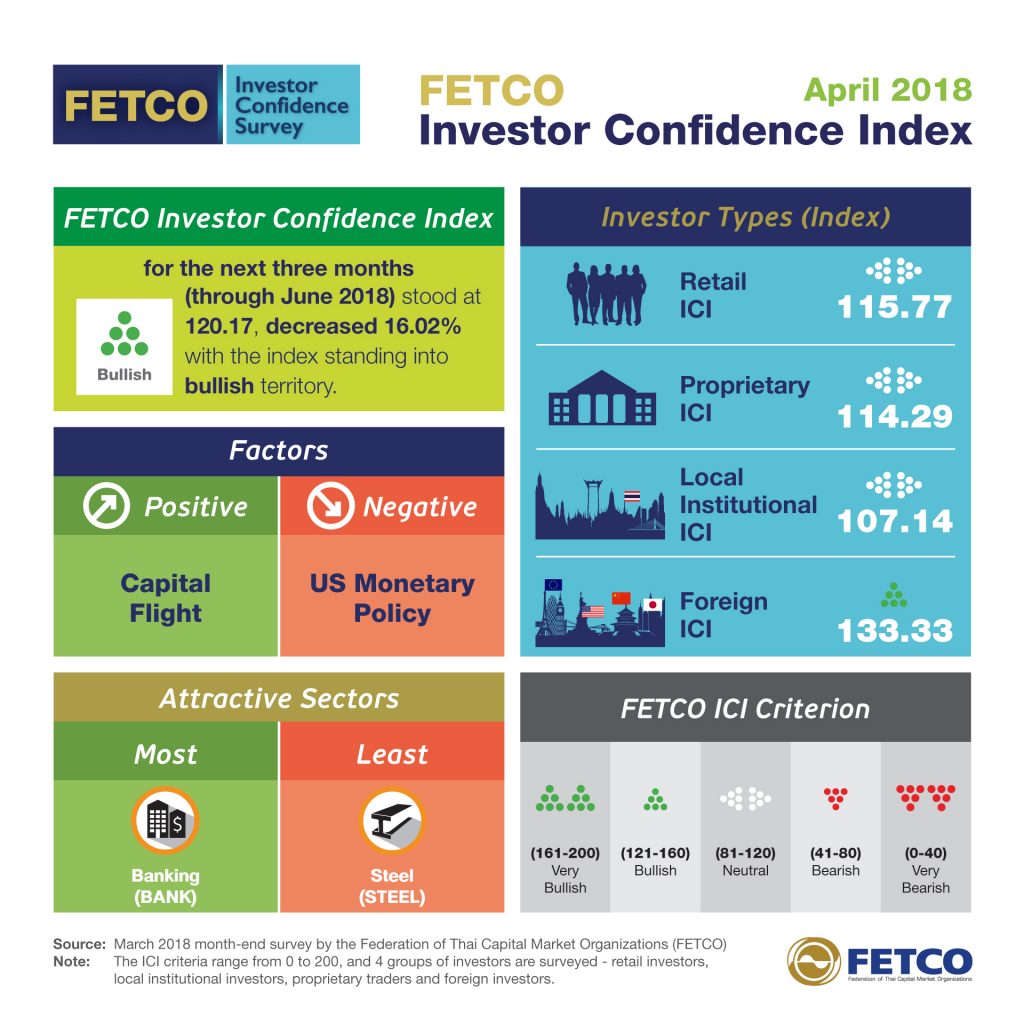

- FETCO Investor Confidence Index (ICI) for the next three months (through June 2018) stood at 120.17, staying within the ICI’s bullish range of 120–160 but falling 16.02% from the previous month’s level of 143.09.

- The foreign investor ICI fell sharply into bullish territory.

- Local institutional investors and retail investors both fell from bullish into the neutral range.

- Proprietary traders remained in neutral territory as in the previous month.

- The Banking (BANK) sector was seen as providing the most attractive investments, while Steel (STEEL) drew the least investor interest.

- The key factor driving investor confidence was capital inflows/outflows, while concern about US monetary policy dampened investor sentiment.

“During March, the Stock Exchange of Thailand (SET) Index reflected rather wide price swings as in the previous month, with the SET Index ranging from 1761 to 1825 points, though most closings hovered around the 1800 mark. The ICI was positively impacted by domestic economic conditions, while declines were due to investor apprehension over US interest rate hikes and worry the possible US trade barriers to international trade war.

. For investment trends over the next three months, investor confidence is boosted by the expectations of international capital flows and domestic economic numbers. However, investors remain wary of what they see as the biggest risk affecting investments, namely US monetary policy which is expected to result in two more interest rate hikes this year after the 0.25% rate hike in March. Additionally, the risks arising from possible enforcement of US-China trade barriers must also be closely monitored for they can impact the world economy, the Thai economy, and individual industries. For economic conditions in other regions, Euro quantitative easing is still ongoing, but a gradual decline in QE is expected towards the end of the year. In Japan, economic conditions for 2017 saw GDP grow to 1.7% from 0.9%, while China’s 2018 6.5% target rate for GDP growth remained stable.”

TH

TH