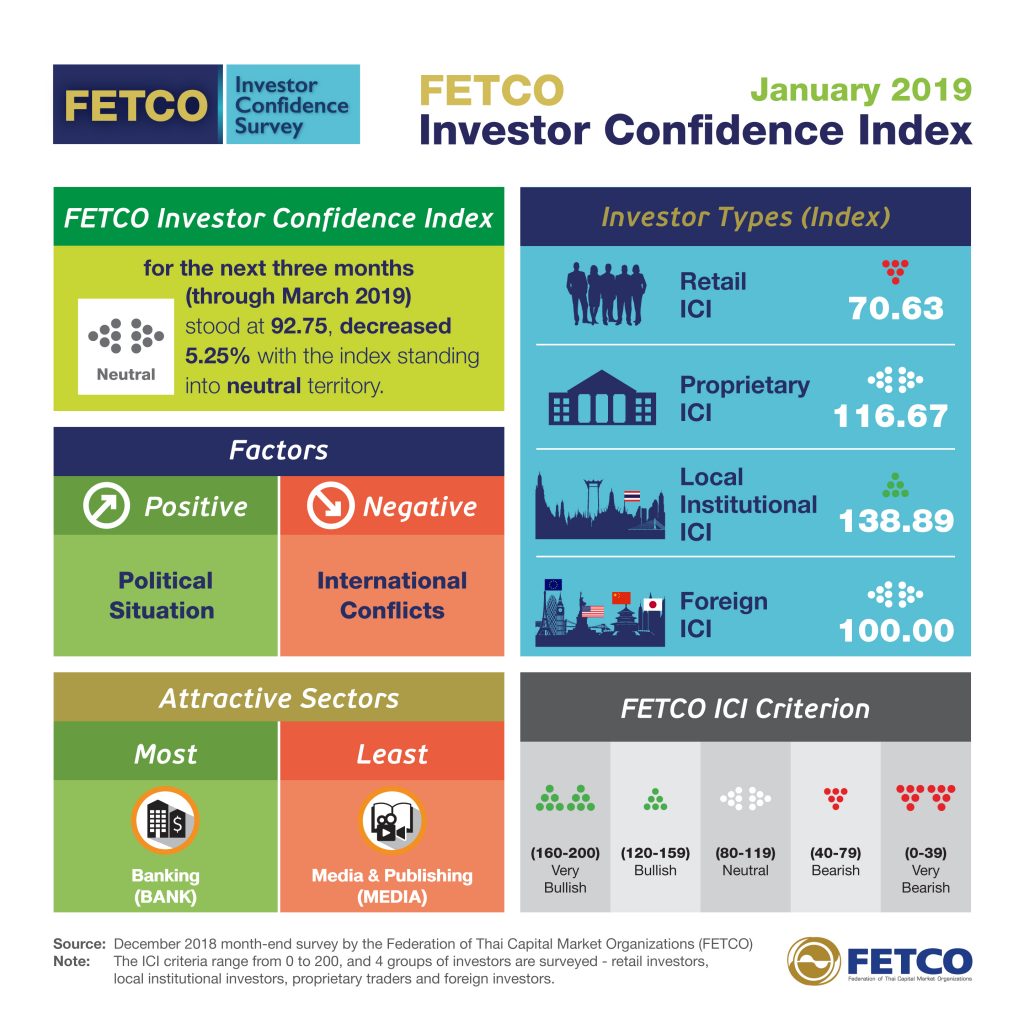

Paiboon Nalinthrangkurn, Chairman of the Federation of Thai Capital Market Organizations (FETCO), commented on the January 2019 FETCO Investor Confidence Index (ICI)

During December, the Stock Exchange of Thailand (SET) Index declined throughout the month from a high of 1672 to a low of 1548.37 before closing at 1563.88 points. This negative trend reflected concerns about the lack of progress in trade negotiations between the United States and China; the 0.25% hike in the US interest rate policy to 2.00–2.25%; the European Central Bank (ECB) announcing the end of quantitative easing (QE) measures; the Bank of Thailand’s interest rate hike for the first time in seven years; and lowered expectations for Thai and global economic growth rates in 2019. For investment trends over the next three months, the main risk factors impacting investor confidence include the continued rate hikes in US monetary policy, concerns about the US-China trade war, and the impacts from the slowdown in global economic growth. Investors are attracted to investment opportunities in Banking (BANK), Tourism & Leisure (TOURISM), and Commerce (COMM), while Media & Publishing (MEDIA), Steel (STEEL), and Property Development (PROP) draw little investor interest. Additional issues to be considered are the progress in US-Chinese trade negotiations, two forecast reductions in the US long-term interest rate in 2019, the vote on the Brexit agreement by the British parliament in January, and the global economy’s signaling a slowdown; other issues affecting investors include Thai interest rate trends after the first policy rate hike in seven years and the upcoming election in early 2019.

TH

TH