Paiboon Nalinthrangkurn, Chairman of the Federation of Thai Capital Market Organizations (FETCO), commented on the June 2018 FETCO Investor Confidence Index (ICI):

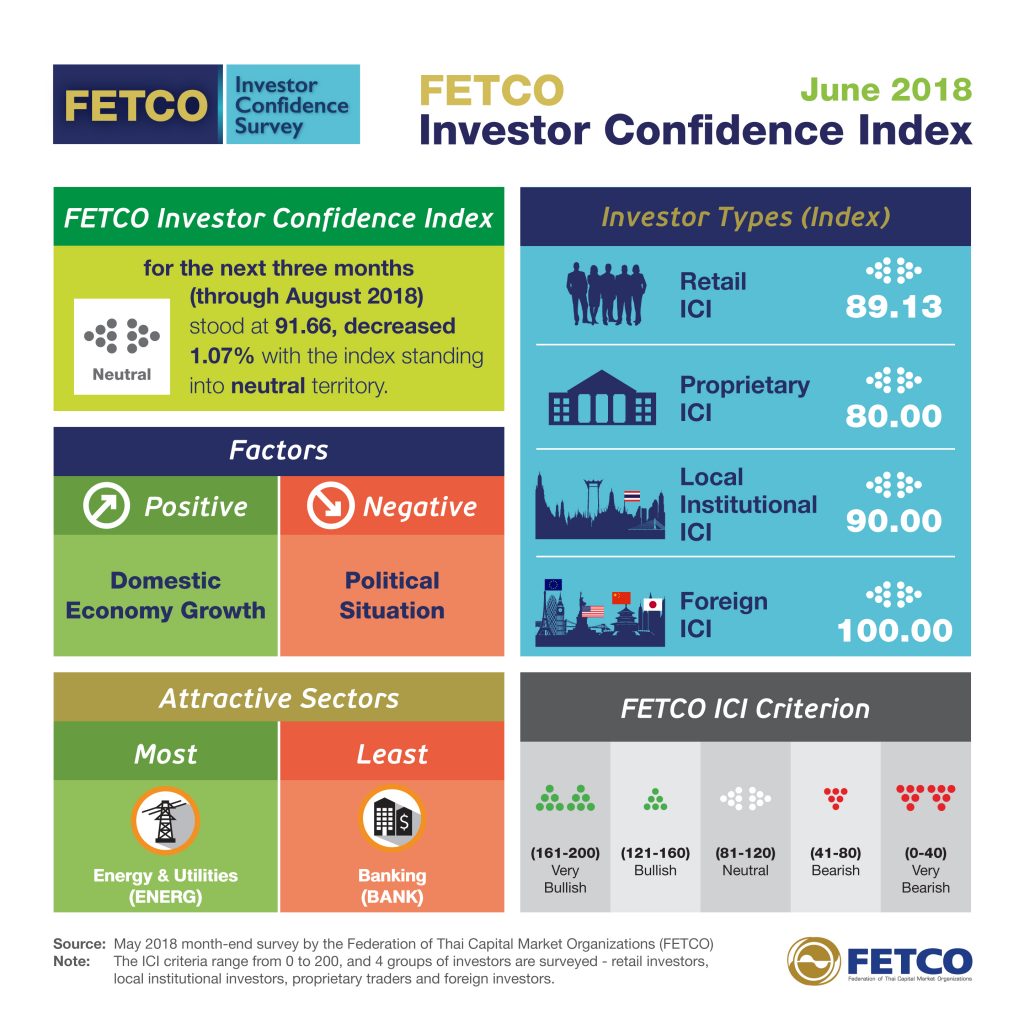

- FETCO Investor Confidence Index (ICI) for the next three months (through August 2018) remained in the neutral range of 80–120, falling 1.07% to 91.66.

- ICIs of both foreign investors and local institutional investors rose from last month’s bearish into the neutral zone.

- Confidence levels among proprietary traders and retail investors declined but remained neutral.

- Energy & Utilities (ENERG) was the most attractive sector for investors.

- The Banking (BANK) sector drew the least investor interest.

- The domestic economy had the greatest positive impact on the Thai stock market.

- The biggest drag on the Thai stock market was the political situation.

“During May, the Stock Exchange of Thailand (SET) Index experienced declines, trending downward within the range of 1724-1791 points. The SET continued to adjust its base, being impacted by US monetary policy forecasts which resulted in US bond yields increasing to 3%. In addition, recent net selling by foreign investors has had a negative impact on the stock market. However, investor concerns about trade barriers between the US and China eased, as negotiations got underway and the US postponed the declaration of import tariffs on Chinese goods.”

“For investment trends over the next three months, investors see a clear domestic economic recovery as first quarter GDP grew by 4.8% and public sector investment rose by 4.4%. Meanwhile, investors are closely monitoring potential risks such as the political situation and the setting of a date for upcoming elections. In addition, Thailand’s inflation rate is gradually rising and may affect the decisions taken by the Bank of Thailand’s Monetary Policy Committee (MPC). Foreign issues such as US monetary policy and European monetary policy with its anticipated year-end reduction in QE measures are also seen as creating risks for investors. Likewise, investors remain wary of the impact of trade barriers and the effects of US monetary policy on trade and monetary policy within ASEAN. For economies in other regions, primary issues to consider include fluctuating oil prices as prices move towards $70 a barrel and the political situation of European countries which may affect monetary policy,” said Chairman Paiboon.

TH

TH