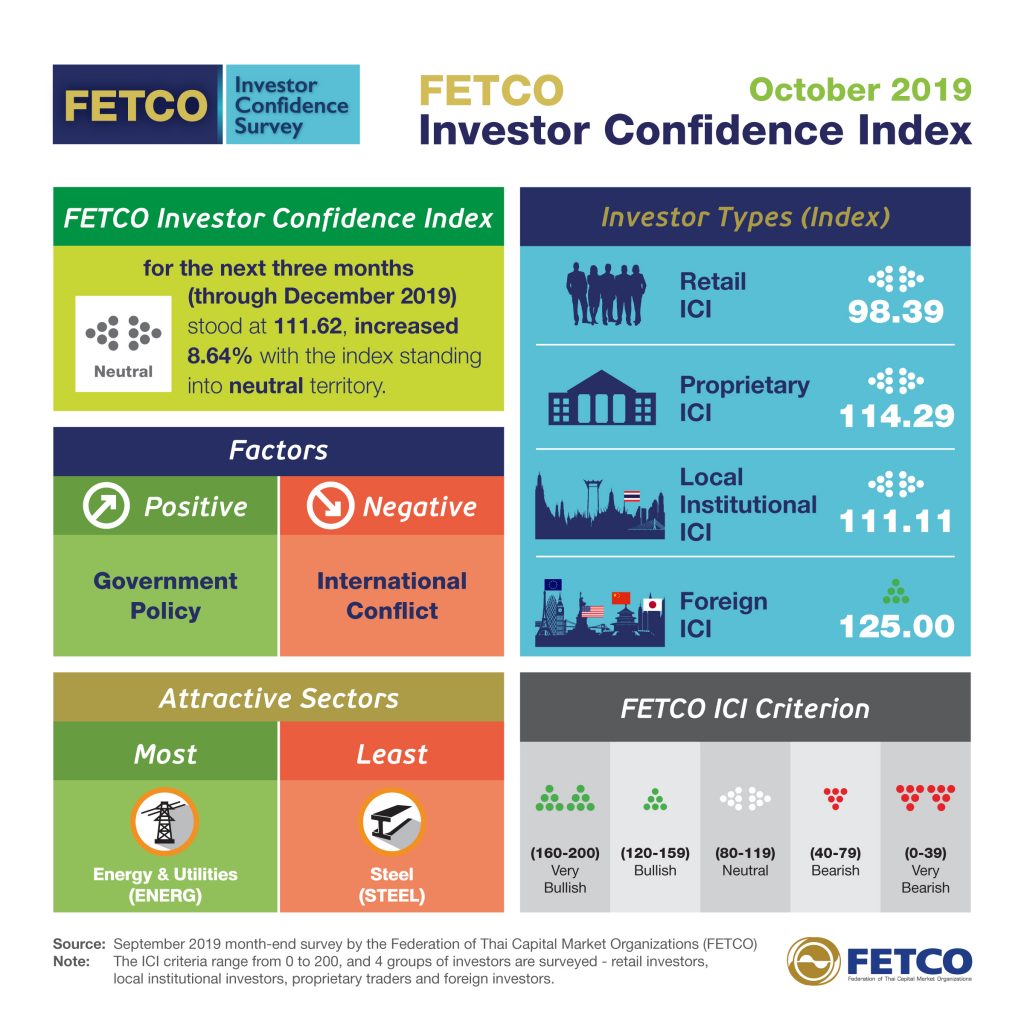

September survey results show the FETCO Investor Confidence Index (ICI) increasing slightly and staying neutral for the second month. Retail investors recovered and rose into the neutral zone from the previous month’s bearish. Local institutional investor and proprietary trader ICIs rose but remained in the neutral zone while foreign investor confidence dropped slightly but stayed bullish.

September survey results show the FETCO Investor Confidence Index (ICI) increasing slightly and staying neutral for the second month. Retail investors recovered and rose into the neutral zone from the previous month’s bearish. Local institutional investor and proprietary trader ICIs rose but remained in the neutral zone while foreign investor confidence dropped slightly but stayed bullish.

During September, the Stock Exchange of Thailand (SET) Index experienced stable movement in a slightly downward direction from the level of 1654 points. The SET Index gradually decreased in the second half of the month after the US Fed cut the policy rate 0.25% but did not signal further rate cuts, causing the SET Index to move in the range of 1630 points at the end of the month. Investment trends for the next three months show the factors bolstering investor confidence the most are government policies with the gradual implementation of economic stimulus measures followed by the domestic economy and capital inflows/outflows. However, investor confidence is primarily being dragged down by uncertainties over international conflicts, despite the US–China trade negotiations appearing more productive. Other factors negatively impacting investor confidence include the impact on the regional economies and the performance of listed companies. International economic factors that investors are closely monitoring include: progress in US–China trade negotiations in early October; the trend in BREXIT negotiations—after the British High Court’s decision to reopen parliament—towards reducing the risk of a No-Deal BREXIT by October 31, 2019; the possible continuation of the US Federal Reserve’s economic easing policy after its second policy rate cut in a year; and the EU’s policy interest rate reductions and additional QE measures. Meanwhile, domestic issues being closely watched include the government’s economic stimulus policy, consideration the draft Budget Act, and future interest rate policy.

TH

TH