Dr. Santi Kiranand, representative of the Federation of Thai Capital Market Organizations (FETCO), commented on the monthly FETCO Investor Confidence Index (ICI) for January 2018 :

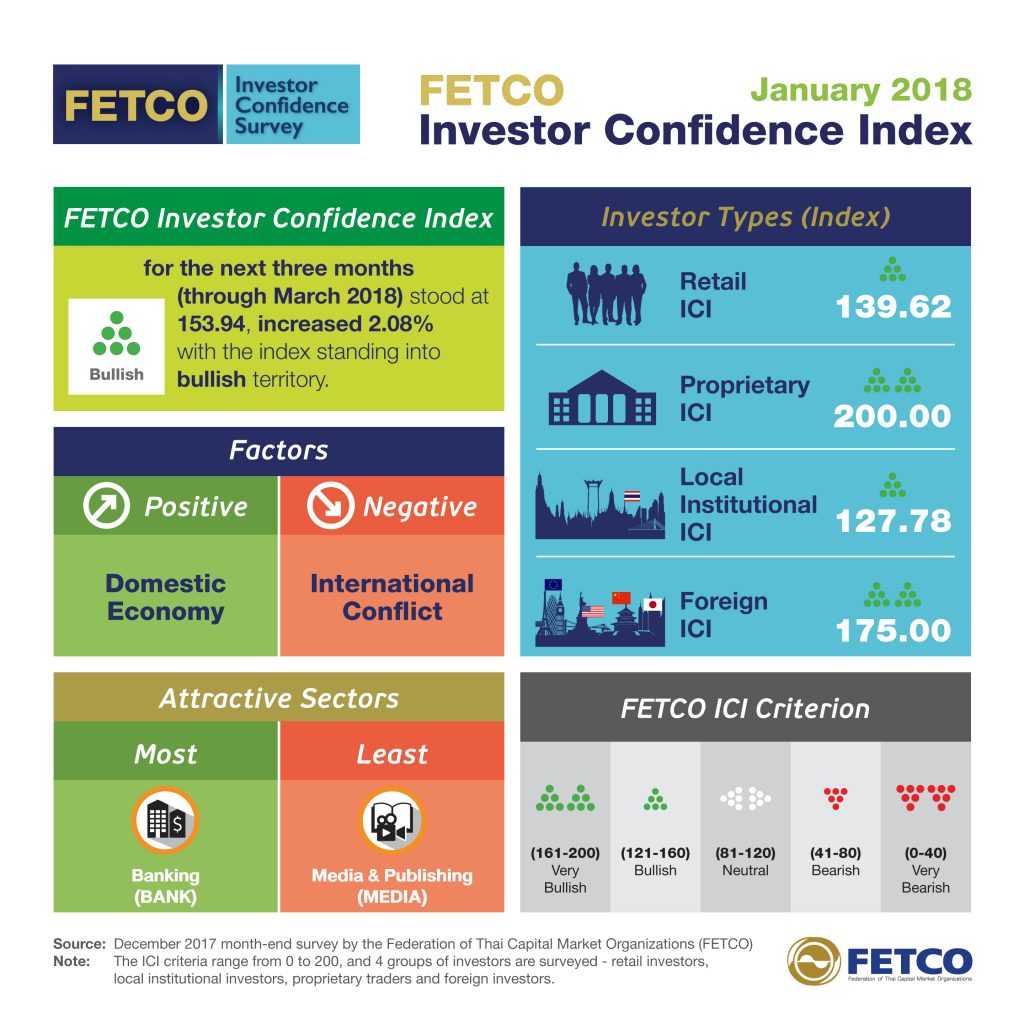

- FETCO Investor Confidence Index (ICI) for the next three months (through March 2018) stood at 153.94, staying within the ICI’s bullish range of 120–160, and up 2.08% from the previous month’s level of 150.81.

- The overall ICI rose as foreign investors remained very bullish and proprietary traders moved up into very bullish territory. ICI’s for local institutional investors and retail investors dropped slightly but remained bullish as they were the previous month.

- Banking (BANK) was the most attractive sector for investors, while Media & Publishing (MEDIA) drew the least investor interest.

- The major factor bolstering investor confidence in the Thai stock market was domestic economic conditions while concerns about international conflict dampened investor sentiment.

“During December, the SET Index moved upward from 1700 points to close at 1753.71, approaching a historic high. Expected domestic economic growth rates of 3.9% in 2017 and 3.9–4.1% in 2018 were key factors boosting investor confidence, and such growth should result from a recovery in private sector investments as well as public utilities investments by the government, which is set to approve projects, begin construction, and make large budget disbursements. In addition, private consumption has started to recover, tourism numbers are growing, and there has been an influx of capital, which has strengthened the baht. These factors have resulted in bullish investor confidence. Foreign factors bolstering confidence include regional economic growth, the continuing rise in the US stock markets, US tax reform, and continued and gradual economic normalization. However, the threat of potential conflict in the Middle East and the Korean Peninsula continues to dampen investor sentiment.”

TH

TH